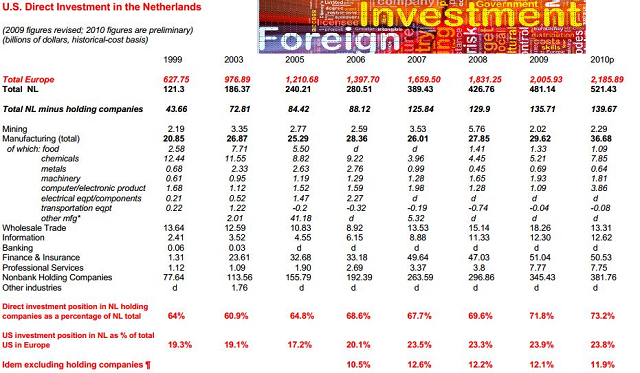

In July 2012 the US Bureau of Economic Analysis published the revised direct investment positions for 2010 and the preliminary figures for 2011. Positions in the Netherlands and the UK were the largest – 14.3 percent and 13.2 percent respectively of the total. For the third consecutive year, the position in the Netherlands was the largest – at $595.1 billion. Most of the position increase and 77 percent of the position in the Netherlands was accounted for by holding companies, which likely invested the funds in other countries.

In 2011 US investment abroad, valued at historical-cost (the book value of US direct investors' equity in, and net outstanding loans to, their foreign affiliates), grew $364.6 billion, to $4,155.6 billion. It grew 10 percent after growing 8 percent in 2010. The growth in the outward direct investment position reflected reinvested earnings, which were at the highest level on record, higher net equity investments, and an increase in foreign affiliates’ indebtedness to their US parents.

The US direct investment position in Europe increased $205 billion in 2011. The largest component of the increase was reinvested earnings, which accounted for nearly three-fourths of the increase. By country, the largest dollar increases were attributable to Luxembourg and the Netherlands, which together accounted for over half of the increase in the region. The position in the Netherlands increased $52.5 billion; the increase was largely attributable to an increase in the position of holding companies and to a lesser extent of wholesale trade. In holding companies, the increase was mainly due to reinvested earnings, and in wholesale trade, the increase largely reflected intercompany debt.

Source: AmCham.nl