Personal income taxes Netherlands

Individuals who are living in the Netherlands (residents taxpayers) are liable on Dutch personal income tax on their worldwide income. Individuals who are living outside the Netherlands (non-resident taxpayers) are only liable to Dutch personal income tax on income received from specific sources in the Netherlands (such as Dutch employment income, director’s fees, business income and Dutch real estate).

Types of taxable income (boxes).

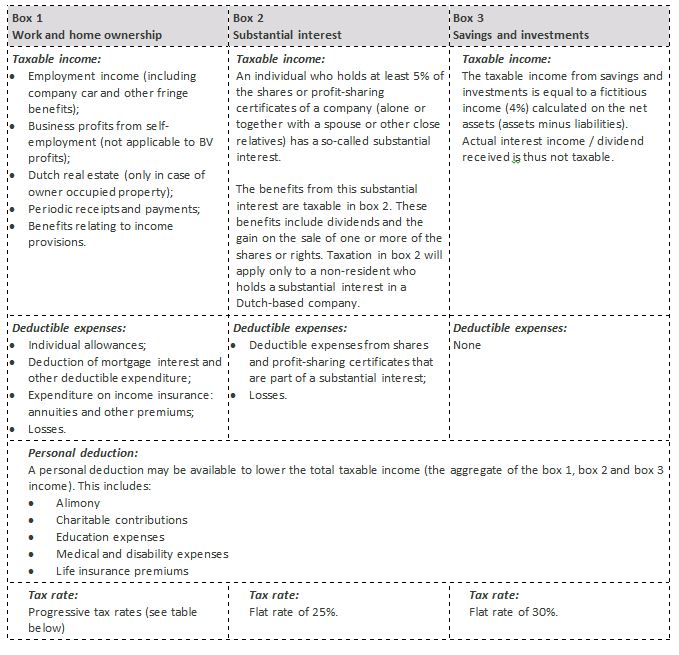

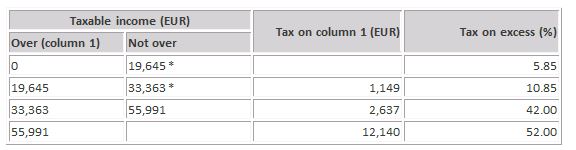

Dutch personal income tax is due on three types of taxable income (boxes). Each box has its own tax rates.

• Box 1: taxable income from work and home ownership

• Box 2: taxable income from a substantial interest.

• Box 3: taxable income from savings and investment.

* In the first and second bracket of box 1, national insurance tax is also levied at a rate of 31.15%.

Personal income taxes Netherlands

Personal income tax returns

Personal income tax returns must be filed after each calendar year before 1 April. The Dutch tax authorities will then issue a tax assessment upon which the taxes due have to be paid (or received in case of a refund). Fiscal partners are able to file a joint tax return. Spouses and individuals in a joint household automatically qualify as fiscal partners. When filing a joint tax return, each partner is still taxed separately for their business income, employment income, pension income, and other periodic payments less premiums for life annuities and for certain other periodic payments. However, the partners can choose to divide certain types of income and / or deductions between each other.