For incomes between 21,000 and 31,000 Euros gross per year, an increase of 1,000 Euros gross can lead to 1000 Euros less in net income. That has to do with fees that will come with higher income, less discounts and tax burden increases.

There are households who earn below an average (36,500 Euros per year) that do not go ahead with a salary increase. And households who will not come quickly over this reasonable limit because of their profession.

Two students of Economics and Law of Saxion University came to this conclusion after they compared eight different model families under the effects of more income tax, rent allowance, healthcare allowance, general tax credit and earned income tax on net income.

Calculate for Yourself

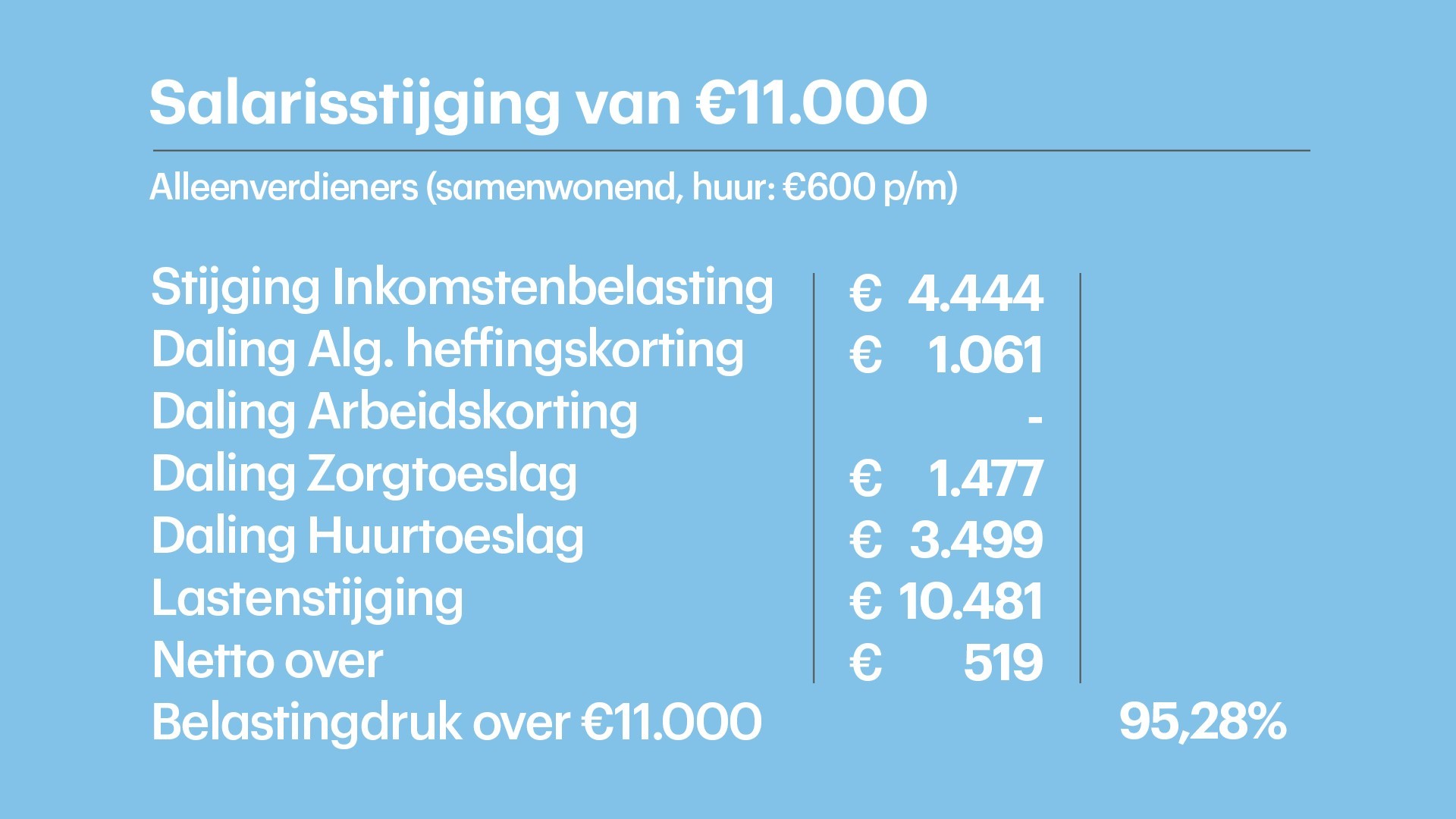

Someone who earns 21,000 Euros per year, living together in a rented home for 600 Euros per month and with a permanent work contract, has per year 500 Euros left over at a gross salary increase of 11,000 Euros. Because the more you earn, the more income tax you pay and less allowances you receive.

Unclear Regulations

According to him, a whole forest of ‘uncertain regimes’ is the cause. “Nobody understands it. The worst thing is that many people do not even know that ‘no’ to a salary increase is sometimes wiser than ‘yes’”. He therefore calls for a revision.“You can see that the whole Dutch tax and allowance system has been fully exhausted”.

Kevin Dobbe together with MartijnWeusthof did this research for their thesis. “You see that surcharges are based on gross income, while you should look at disposable income”, he says.As an example, he gives the “hard limit” in the rental surcharges. “A euro wage increases can lead to 1,300 Euros less disposable income”. He also recommends a simplification of regulations, including the slower phasing out of allowances with a rise in income. “These are well-intentioned schemes but disastrous in practice”.

If you want to know what this means for your income, this can be calculated using a tool.

Source: http://www.rtlnieuws.nl